In 2010, along with the religious persecution that hit His Divine Holiness Paramahamsa Nithyananda and His disciples in an onslaught of violent attacks, a number of previously closed cases were re-opened, calling into question the tax free status of the charitable trusts and their rightfully claimed donations. The cases were eventually closed as the commissioner found no fraud in any of the Adheenam’s financial dealings, but not before the ordeal caused much pain and suffering to devotees.

NITHYANANDA DHYANAPEETAM

“Integrity, economic chastity and dharma are the pillars on which the accounts and finance teams of Nithyananda Mission stand.” His Divine Holiness Paramahamsa Nithyananda said when he blessed his disciples to register the charitable trust.

Nithyananda Dhyanapeetam prides itself on keeping clear books and has always been free of black money. All the Donations are properly accounted for, catalogued, and receipts are issued to the donors. There has never been any concealment of income or misappropriation of funds. This is why none of the trust cases were ever selected for compulsory scrutiny; the trust is always able to show the clear and complete paper trail that accounts for every rupee donated and every rupee spent.

How is it that the charitable trust was used in an illegal attack that threatened the very lives of adheenavasis living at Nithyananda Peetam Bengaluru Adheenam? Income tax collection and management is a function of the central government in India, which applies to individuals as well as organizations. Nithyananda Dhyanapeetam is a registered public charitable trust, which has a tax exemption for donors as well as the organization. However, during the time of the media attack against Paramahamsa Nithyananda, in an illegal attempt to seize the money on which the residents of the adheenam survived, the income tax assessments were re-opened, in a ruthless attempt to grab money from the already suffering monastic community.

The income tax department claimed to suspect concealment of income by the Trusts, and hence issued notice u/s.148 of the Income tax Act of 1961 in August, 2010, to all the Trusts and re-opened all the cases (which had previously been closed) from the time of their inception in 2005-06.

Here is the Nithyananda Dhyanapeetam case for A.Ys. 2006-07, 2007-08, 2008-09 and 2009-10. For all these years notice u/s.148 was issued on 30/08/2010 to reopen the assessments and ascertain the anonymous donation within the meaning of Sec.115BBC and charge tax at the maximum marginal rate. The assessing officer justified his decision to re-open the assessment by making a huge addition, however, the ld. Commissioner of Income tax (appeals) who really had income tax knowledge knocked down all the demands, stating the reopening is completely against the law.

The Commissioner of Income tax (appeals) has very clearly mentioned that the assessment reopened is unlawful. The income tax Department’s Appellate authority gives a crucial expert opinion as to the illegality of the attack against the organization’s donations. The most important point to be noted here is that Department did not file any appeal against this order with Income tax Appellate Tribunal and accepted the order of CIT(A).

Although the ordeal ended in victory on behalf of Nithyananda Dhyanapeetam, the case took a severe toll on the well being of many innocent people.

“For three weeks, we had to live on rations meant for a few days,” says Ma Nithya Brahmanjnananda, as she wipes away tears that show the pain is still fresh, even years after the incident. “When the accounts were frozen, I was among a team of volunteers led by Ma Lokanayaki, Paramahamsa Nithyananda’s own mother. She sat for hours on end, picking through bags of rotting dhal, painstakingly separating the good lentils from the bad. She was covered in bugs but kept working so that we could all eat.”

We often forget the human toll taken by government actions and corporate decisions. In the myriad false cases against Nithyananda Dhyanapeetam, however, the cost to human life can never be ignored.

Below is an excerpt from the case, showing Nithyananda Dhyanapeetam’s full cooperation with the tax office, and open accounts:

DHYANAPEETA CHARITABLE TRUST

DHYANAPEETA CHARITABLE TRUST case was re-opened for A.Ys.2005-06, 2006-07, 2007-08, 2008-09 and 2009-10.

For all these years the Assessing Officer was of the belief that income had escaped assessment by wrongful claims and claiming double deduction. Also, that the receipts and payments account does not give a true and accurate picture of the money received and deposited. The assessing officer completed the report by making a huge addition to the numbers, thereby raising a demand of around 32 lakhs on the trust.

The Commissioner of Income tax has himself stated that the action of the AO is not sustainable in the eyes of the law. The whole action of the Income tax department boils down to putting pressure on and giving harassment to Swamiji and His Sangha and Sanyasis, threatening their quality of life and sustainability.

The first line on the fourth page of the assessment of this case states, in the direct words of the Commissioner:

“It is submitted that the Learned Assessing Officer has no tangible evidence which is newly coming to his possession for the purpose of forming a belief that income tax has escaped his assessment.”

Here is one excerpt from the 18 page report, dismissing the case:

NITHYANANDESHWAR DEVASTHANAM TRUST

Till the F.Y. 2009, no case against Nithyanandeshwar Devasthanam Trust was ever selected under CASS. Suddenly, during the persecution time, however, in the month of August, 2010, the Income Tax Department issued notice u/s.148 of the Income tax Act for A.Ys. 2006-07, 2007-08 and 2008-09 stating that the Trust has violated the conditions of Sec.11(2) of the Income tax Act and has escaped income. In this process, they raised a huge demand.

However, the ld. CIT(A)V, Bangalore had passed a very crisp order deleting the entire demand raised by the AO. The conclusion of the appellate order is reproduced as below, very clearly showing that the cases were re-opened without any basis and just for the sake of harassment. This is just one small excerpt from a 6 page document proclaiming the innocence of the Trust:

NITHYA GNANADAAN TRUST

Gnanadaan Trust, the charitable trust opened to provide free books, literature, translations of sacred texts and more, was also re-opened for two years 2007-08 AND 2008-09 for the reason that some anonymous donations have been received and also that foreign donations have been received without registration under FCRA.

Till 2010, none of the cases were re-opened. Suddenly, in August 2010, these two years of cases were re-opened. Demand was raised by the Assessing Officer since the accumulation of income claimed by the assessee u/s 11(2) of the IT Act is not adhered the formalities and also there appearances to be certain anonymous donation. Hence notice u/s 148 was issued on the assessee to assessee the income escaped on 18/8/2010.

“Swamiji always provides us with everything we need, never bothering about cost compared to quality of life,” says Ma Nithya Bhaktikananda Swami. “He always showers us with ample food, clothing, and quality shelter. This case against the trust forced us into a false famine situation, much like those endured by our ancestors under British rule. This tactic of cutting off the source of food is used in times of genocide and ethnic cleansing, and I can’t help but draw parallels between our sad ordeal and the darkest hours of our past. Is it our order being attacked, alone, or is Hinduism once again in peril at the hands of an oppressive but covert power in government? Time will tell.”

The Assessing Officer made the addition and raised a huge demand against those assaulting the trust. The ld. CIT(A) did due diligence to us by properly following the Income tax Rules and granted us a huge victory in this false case. An excerpt of his conclusions are reproduced below:

NITHYANANDA FOUNDATION

A.Ys.2007-08 and 2009-10 were reopened in this case. The reason was anonymous donation and also accepting foreign donations and the trust not yet registered under FCRA . The Assessing Officer without giving proper opportunity of being heard to the Trust and without proper verification made the addition of the donations received and thus raised a huge demand.

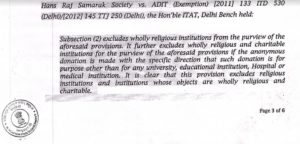

However, the ld.CIT(A), Bangalore did due diligence. Read the case thoroughly and passed an order in favour of the Trust as all the details were submitted by us. It is stated in the report, and highlighted, that purely religious institutions receive tax exemption to all anonymous donations:

To sum up, all the cases reopened by the Income tax Department resulted in our favour by bringing it to the notice of the Income Tax Authorities that this Dhyanapeetam is functioning as per the laws laid down by the Government and no illegal activity or Black Money.

Whatever may be the harassments, ultimately it is only the sincerity and honesty of Paramahamsa Nithyananda and members of Nithyananda Sangha that becomes VICTORIOUS.